Understanding your paycheck in the United States goes far beyond the gross annual salary number. Between federal income tax, state levies, FICA contributions, and various deductions, the journey from your gross salary to your actual take-home pay can feel like navigating a maze. This is where a powerful tool like the Salary Calculator AI steps in, providing clarity and helping you gain crucial control over your financial future.

Unlocking Your Take-Home Pay with a US Salary Calculator

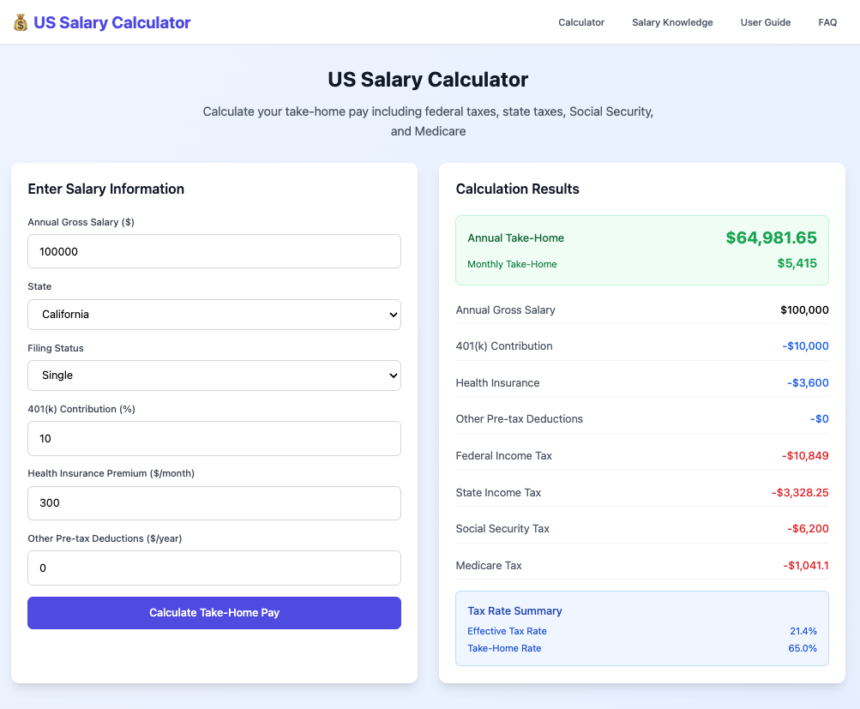

The primary purpose of a salary calculator is to provide an accurate estimation of your net pay after all mandatory deductions and voluntary contributions. The US Salary Calculator feature within the tool is specifically designed to handle the complex layers of the US tax system: federal income tax, state income tax, Social Security, and Medicare.

By simply entering your annual salary, state of residence, and filing status, you can instantly see a detailed breakdown of your expected paycheck. This clarity is not just for curiosity—it’s the foundation for sound financial planning.

The Pillars of US Salary Knowledge

To truly optimize your financial life, you need to understand the core concepts that shape your gross pay into your take-home salary.

Federal Income Tax: The Progressive System

The federal income tax is based on a progressive system, meaning that as your income increases, the rate at which you are taxed on the additional income also increases. The current brackets range from 10% to 37%.

Marginal Tax Brackets: Remember, tax brackets are marginal. If you fall into the 22% bracket, only the portion of your income that exceeds the 12% bracket threshold is taxed at 22%. A powerful salary calculator helps illustrate the impact of these marginal rates on your actual tax bill.

The Standard Deduction: Key to reducing your taxble income is the standard deduction (tax, $15,750 for single filers in a recent year). Utilizing tax-advantaged accounts, like a 401 (k) or IRA, is a smart “Pro Tip” to l401 r your Adjusted Gross Income (AGI) and potentially reduce your effective tax rate.

State Income Tax: A Critical Difference

State income taxes represent a major variable often overlooked when comparing job offers. While states like Texas, Florida, and Washington have no state income tax, states like California and New York can have rates exceeding 10%.

The difference in state tax rates can lead to a substantial variation in your effective take-home pay. Before relocating or accepting a new role, running the numbers through a sophisticated salary calculator to compare net incomes is an absolute must.

FICA: Social Security & Medicare

FICA (Federal Insurance Contributions Act) fund the critical Social Security and Medicare programs.

Social Security: A flat rate of 6.2% on wages up to an annual limit (e.g, $176,100 for 2024).

Medicare: A flat rate of 1.45% on all wages, with an additional 0.9% for high earners (e.g. over $200,000 for single filers).

These are non-negotiable taxes that must be factored into every salary calculation. It’s important to note that your employer matches these contributions, doubling the total funding for these programs.

Strategic Deductions for a Better Take-Home Pay

Beyond mandatory taxes, several voluntary pre-tax deductions can significantly influence your net pay while simultaneously boosting your financial security.

401(k) Retirement Plans: Contributions to a traditional 401(k) are made with pre-tax dollars, immediately lowering your taxable income. Aim to contribute at least enough to secure the full employer match—it’s essentially free money. The contribution limits are generous.

Health Insurance Benefits: Employer-sponsored health premiums are typically paid with pre-tax dollars, again reducing the income subject to taxation. For those with high-deductible health plans, maximizing an HSA (Health Savings Account) offers the rare “triple tax dadvantagee” (deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses).

Tax Planning Strategies for Optimization

The power of a salary calculator is fully realized when used for proactive tax planning. By strategically adjusting pre-tax contributions and understanding the timing of income and deductions, you can legally minimize your tax liability.

Maximize Pre-Tax Contributions: Use the calculator to see the direct impact of increasing your 401(k) contribution on your monthly take-home pay and tax bill.

Review Annually: Tax laws and limits (like the standard deduction or contribution caps) change yearly. An annual check with the Salary Calculator AI ensures your withholding is accurate, preventing an unexpected tax bill or a need for less smaller refund (which means you overpaid the government interest-free all year).

Conclusion

Your salary is one of your greatest assets. Utilizing a powerful, detailed salary calculator like the Salary Calculator AI is the first step toward transforming your financial life. It moves you from passively accepting your paycheck to actively optimizing your earnings, allowing you to confidently plan for everything from daily budgeting to long-term retirement goals.

The tool’s simple, four-step guide—Enter Info, Add Deductions, Review Calculations, and Plan & Optimize—provides a clear path to understanding every dollar that flows through your paycheck. Stop guessing and start knowing.