The New Mobile App from OnlineCheckWriter.com – Powered by Zil Money Is Redefining Cross-Border Payment Modernization

Fast International Payments are no longer a nice-to-have—they are the new foundation of global business resilience. But outdated assumptions still hold businesses back.

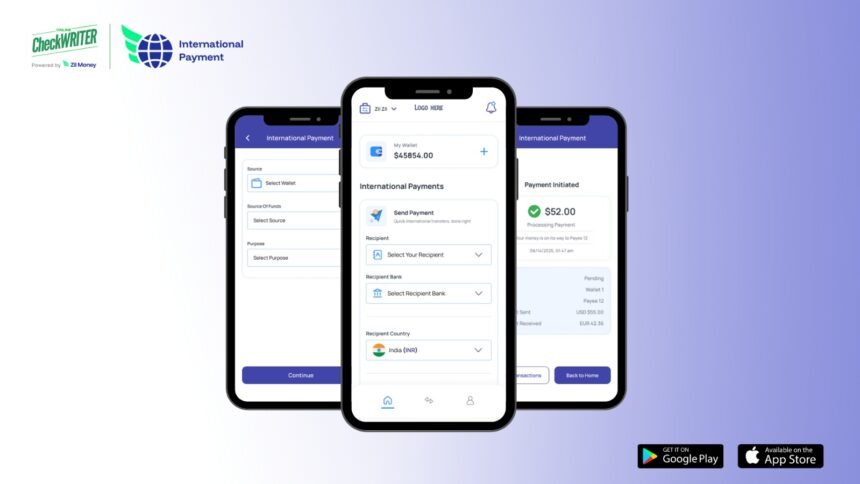

The new mobile app from OnlineCheckWriter.com – Powered by Zil Money steps in as a game-changer. Designed for modern commerce, it delivers speed, transparency, and compliance. Let’s bust the myths that keep global payments stuck in the past.

Myth 1: International Payments Always Take Days

Reality: The waiting game is over. Traditional systems forced businesses to endure delays, slowing supply chains. With mobile payment transaction volume reaching $7.39 trillion in 2023—a 14% annual increase —and over two billion people using mobile payments globally, the app capitalizes on this momentum. Funds now move across continents in minutes.

Myth 2: Cross-Border Transfers Are Packed with Hidden Fees

Reality: The era of opaque pricing is done. With global payments expected to reach approximately $290 trillion by 2030 , transparency has become essential. The platform eliminates hidden charges by offering full transparency upfront. No surprise deductions, no shrinking margins—just clear, predictable costs.

Myth 3: Compliance Is Complicated and Risky

Reality: Regulatory requirements around anti-money-laundering (AML) and know-your-customer (KYC) are getting stricter worldwide. But instead of slowing payments down, the app automates safeguards. With global payment revenues projected to reach $2.3 trillion by 2028, compliance automation has become critical. Every transaction is secured and aligned with global standards.

Myth 4: Only Large Enterprises Can Afford Modern Payment Solutions

Reality: Modernization isn’t reserved for the giants. The global mobile payment market was valued at $2.98 trillion in 2023 and is estimated to increase to $27.81 trillion by 2032 , making advanced payment solutions increasingly accessible. The app makes fast international transfers affordable, leveling the playing field. Whether paying global contractors or managing suppliers, businesses of all sizes can now operate efficiently.

Myth 5: International Payments Can’t Be Managed on the Go

Reality: Payments now travel as quickly as messages. With the North American mobile payment market expected to reach $145.3 billion by 2030, driven by B2B adoption, mobile-first solutions have proven their value. The mobile app enables businesses to send, track, and confirm transfers from anywhere. What once required a desktop system now happens instantly from a phone.

The Bigger Picture: Why This Matters in 2025

Cross-border trade is no longer an exception; it’s the rule. Global partnerships are reshaping how companies grow. With digital wallet transactions in e-commerce estimated to grow at an 18% CAGR between 2024 and 2030 , the shift toward digital-first payment solutions is accelerating rapidly. But outdated systems have historically weakened resilience.

Fast International Payments flip the script. They reduce operational risk, strengthen supplier trust, and open the door to digital commerce. This is about future-proofing business operations where speed and transparency define competitiveness.

Platform Innovations Driving the Shift

What sets this modernization apart are the breakthroughs inside the app:

- Instant settlement capabilities:Transfers clear within minutes.

- Multi-currency support:Flexibility to pay partners in their local currency.

- Integrated compliance checks:Automated safeguards align with global standards.

- Mobile-first access:Manage global transactions from anywhere.

These innovations turn cross-border payments from a liability into a growth strategy.

Thought Leadership: The Road to Digital-First Global Commerce

The digital-first shift in payments isn’t a passing trend—it’s the next era of commerce. With 208.5 billion digital payment transactions recorded in 2024, businesses that embrace it are better equipped to handle regulatory shifts and growing international partnerships. Those who hesitate risk being left behind.

The message is clear: adopting fast international payments today is about staying ahead.

The next move!

The myths have been broken. Modernization has arrived. Fast International Payments are no longer complex, costly, or slow. The new mobile app from OnlineCheckWriter.com – Powered by Zil Money makes cross-border transfers simple and affordable—built for the way global business successfully works in 2025.

Download now on the App Store or Google Play Store and future-proof the way money moves seamlessly worldwide today.

FAQs

Q1. How fast are transfers completed with the app?

Payments settle in minutes, eliminating the multi-day delays of older systems.

Q2. What regions are supported?

The app currently supports major global corridors, including Europe and Asia-Pacific.

Q3. Is special infrastructure required to use the platform?

No, it’s mobile-ready. Simply download the app and start sending.