Starting a business in Florida comes with several legal requirements, and one of the most important among them is deciding how your company name should be structured. For entrepreneurs planning to form a Limited Liability Company, one common question arises: does Florida require LLC in the name? The answer holds significant weight, not just for compliance but also for building a professional image. Understanding this requirement means diving into state regulations, branding implications, and the process of registering a business name properly.

Before registering your business, a quick Florida LLC name search is essential. It ensures your name is unique, compliant, and clearly shows your company is a limited liability entity. Follow this guide to understand why it matters and how to get it right from the start.

Florida’s rules are designed to help consumers clearly identify the type of business they are dealing with, which means that certain words or abbreviations must appear in the legal name of your company. This ensures transparency and protects the public by making it obvious when a company is operating as a limited liability entity. In this guide, we will explore every angle of this requirement, the reasons behind it, and what entrepreneurs need to do to stay compliant.

Importance of Naming Rules for Florida LLCs

Choosing a name for your company is not only about branding; it also has legal implications. In Florida, the name of your LLC must meet certain guidelines set forth by the Division of Corporations. These guidelines are in place to prevent confusion, misrepresentation, and misuse of certain terms that could mislead the public. By requiring LLC in the name, the state ensures that anyone dealing with your business knows its legal structure immediately.

The importance of these naming rules extends beyond paperwork. They also help establish credibility with customers, investors, and business partners. When someone sees “LLC” after your company’s name, they understand that the business operates under the limited liability model. This means that the owner’s personal assets are protected in case of lawsuits or debts, which gives both the business and its stakeholders a sense of security.

Legal Requirement for LLC in Florida

Under Florida Statutes, every Limited Liability Company must include the words “Limited Liability Company,” or the abbreviations “LLC” or “L.L.C.,” in its official name. This requirement applies to all entities registering as LLCs, regardless of their size or industry. You cannot register a company as an LLC without having one of these identifiers clearly placed at the end of the name.

This legal mandate exists because the state wants the public to distinguish between sole proprietorships, partnerships, corporations, and limited liability companies. Without this requirement, consumers may be misled about the protections and responsibilities that come with doing business with a certain entity. In practice, it also makes it easier for state authorities and courts to handle legal matters related to the company.

Why Florida Requires LLC in the Name

The inclusion of LLC in the company name provides clarity about the structure of the business. It signals to clients, customers, and other parties that the company has limited liability protection, which means the owners are not personally responsible for business debts. This distinction is critical in avoiding disputes and ensuring transparency in business operations.

From the state’s perspective, requiring LLC in the name ensures compliance with broader corporate governance standards. It also reduces the likelihood of fraudulent activities where individuals may try to present themselves as a different type of entity than they really are. This rule is part of a larger effort to maintain trust in the Florida business environment.

Acceptable Variations of LLC in Florida

Florida law is flexible in how the required designation appears, as long as it is clear. Business owners can use the full phrase “Limited Liability Company” or abbreviations such as “LLC” or “L.L.C.” Some companies prefer the full version because it looks more formal, while others opt for abbreviations to maintain a cleaner, more modern branding style. Both are legally acceptable.

It is worth noting that while variations are permitted, you cannot shorten the designation in a way that creates ambiguity. For example, using only “LTD” or “Co.” is not acceptable for an LLC in Florida. These terms may apply to other types of entities and could confuse customers or legal authorities. Therefore, sticking to the approved formats is essential for compliance.

Consequences of Not Including LLC in the Name

Failing to include LLC in your business name can lead to significant problems. The Division of Corporations will reject your Articles of Organization if your chosen name does not meet the requirement. This delays your business registration process and could set back your launch timeline by weeks or months.

Even if you somehow operate without including LLC in the name, you risk misleading customers and creating legal exposure. In court, the absence of proper designation could undermine your liability protection and blur the line between personal and business assets. Essentially, not including LLC where required defeats the very purpose of forming an LLC.

Difference Between Legal Name and Trade Name

It is important to understand the difference between your company’s legal name and its trade name. The legal name is the official name registered with the state, and it must include LLC or Limited Liability Company. The trade name, often referred to as a “doing business as” or DBA name, does not necessarily have to include LLC.

For instance, if your company’s legal name is “Sunshine Marketing LLC,” you could register a DBA as “Sunshine Marketing.” This allows you to market your business under a simpler or more brand-friendly name, while still maintaining legal compliance with state naming rules. However, for contracts, bank accounts, and other official matters, the full legal name with LLC must always be used.

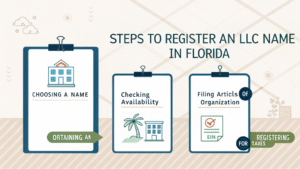

Steps to Register an LLC Name in Florida

The first step in registering an LLC name in Florida is conducting a name search through the Division of Corporations. This ensures that the name you want is not already taken by another entity. Once you confirm availability, you can file your Articles of Organization with the state, making sure to include the required LLC designation.

During the registration process, you will also pay a filing fee and provide basic information about your company, including its principal address, registered agent, and members or managers. Once approved, your name becomes official, and you must use it in all legal and professional contexts. The process is straightforward but must be followed carefully to avoid delays.

How to Check Name Availability

Florida provides a free online tool through the Division of Corporations where you can search for existing business names. This database is updated regularly and allows you to confirm whether your preferred name, including the LLC designation, is available. Checking availability is a critical step before filing your paperwork.

If your name is too similar to an existing business, the state may reject it. Florida requires names to be distinguishable from one another to prevent confusion in the marketplace. Therefore, it is wise to have multiple name options prepared before you begin the search process.

Using a Registered Agent for Compliance

Every LLC in Florida must designate a registered agent who is responsible for receiving legal documents on behalf of the company. This individual or service can also help ensure that your business name complies with state rules. Some entrepreneurs rely on professional registered agent services to guide them through the naming and filing process.

Working with a registered agent has additional benefits, including privacy protection and assistance with annual reporting requirements. While the agent’s main role is not directly tied to your company name, their expertise can help you avoid costly mistakes in meeting compliance obligations.

Common Mistakes in Naming Florida LLCs

One common mistake business owners make is trying to register a name that is too similar to an existing company. Another is leaving out the required LLC designation, which results in an automatic rejection. Some also attempt to use restricted words such as “bank,” “insurance,” or “university” without the proper approvals, which complicates the process further.

Another frequent error is failing to distinguish between the legal name and the trade name. Entrepreneurs sometimes assume they can use the trade name for official purposes, only to discover later that legal contracts and filings must use the full legal name with LLC included. Avoiding these mistakes requires careful planning and attention to detail.

Branding Considerations with LLC in the Name

From a branding perspective, including LLC in your company’s name has both advantages and challenges. On the positive side, it signals professionalism and credibility. Customers may feel more confident doing business with an LLC than with a sole proprietorship or informal business.

On the other hand, some business owners worry that adding LLC makes their name appear less sleek or too formal for certain industries. This is where using a trade name or DBA can be helpful, allowing you to maintain creative branding while meeting legal obligations.

Florida Statutes Governing LLC Names

The legal authority behind Florida’s naming rules comes from Chapter 605 of the Florida Statutes, which governs Limited Liability Companies. These statutes spell out exactly what must be included in the company name, acceptable abbreviations, and rules for distinguishability. Understanding these statutes helps business owners appreciate why compliance is non-negotiable.

By following the statutes, business owners not only protect themselves legally but also gain a better understanding of the rights and responsibilities that come with forming an LLC in Florida. These laws form the backbone of the state’s business regulation framework.

Maintaining Compliance Over Time

Once your LLC is formed, compliance does not stop there. You must continue using your legal name with the LLC designation in all official matters. This includes contracts, bank accounts, government filings, and tax documents. Failure to do so could result in confusion or even legal disputes.

Additionally, Florida requires annual reports to be filed by all LLCs to maintain active status. When submitting these reports, you must always use the full legal name, including the LLC designation, as registered with the state. Maintaining accuracy ensures your business stays in good standing.

Can You Change Your LLC Name Later

Yes, Florida allows you to change the name of your LLC if needed. This requires filing Articles of Amendment with the Division of Corporations and paying a filing fee. When changing the name, you must still include the LLC designation, as this requirement never goes away.

Businesses often change names to rebrand, reflect new services, or resolve conflicts with similar company names. While this process is not overly complicated, it does require updating all legal documents, contracts, and registrations with the new name.

Practical Examples of Florida LLC Names

To better understand how these rules apply, consider examples of compliant names such as “Ocean Breeze Consulting LLC” or “Tampa Real Estate Investments L.L.C.” Both use acceptable variations of the designation and meet the state’s guidelines.

In contrast, names like “Ocean Breeze Consulting” without the LLC designation or “Tampa Real Estate Investments Co.” would be rejected. These examples highlight how easy it is to stay compliant as long as you include the proper identifiers.

Final Thoughts on LLC in Florida Business Names

Including LLC in your company’s name in Florida isn’t just a formality, it’s a must for anyone looking to start an LLC in Florida. This simple step ensures your business is clear, transparent, and fully compliant with state rules, protecting both you and your customers from unnecessary risks. It’s also important to stay aware of the Sunbiz LLC renewal fee, which keeps your business in good standing year after year.

When starting a business, paying attention to details like naming requirements may feel tedious, but it sets the foundation for long-term success. Florida’s clear rules make it straightforward: if you are forming an LLC, make sure LLC or Limited Liability Company appears in your name.